firstminute capital, founded by Brent Hoberman and Spencer Crawley in 2017, has launched their third $100M seed fund. Backed by 130 unicorn founders, and a host of global CEOs, firstminute will leverage its unrivalled network to back and connect the very best early stage businesses in Saas, fintech, deeptech, healthtech and more.

To understand how firstminute achieves it’s mission to become the preeminent European seed franchise able to back the next generation of European unicorns, we spoke to the whole team.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Spencer Crawley, Cofounder and General Partner

What is your vertical and what made you specialise in this area?

Business-building within venture has been my “vertical”. Souls running venture firms probably spend most of their time on hiring and managing a team (>70% of their stress, like any business?), fundraising, and working out how the firm stays differentiated within its peer group. On one side, the product of venture capital is a bespoke consultancy offering to its portfolio founders; on the other, it is an offering within a crowded asset class, where investors (Limited Partners) need to believe that your firm can make them outsized returns, based on the firm’s track record, access and decision-making. Both products need to have happy customers, so I try to focus most of my energy on how to keep improving these two interlinked but separate facets of the business. (Short answer for me: keep restlessly working out how we can build and retain an unfair competitive brand advantage). In terms of actual technology sectors… I hope to be able to answer this with a flurry of clever-sounding sector and sub-sector specialisations by the time we announce firstminute IV. If not, then I am a generalist for life.

What makes you want to invest in a startup?

A belief in a founder’s obsessiveness, insight and resilience – and something mildly magnetic that makes you want to be their cheerleader, so that in time you can derive vicarious glory from their inevitable future success.

How do you quantify success?

Enjoyment of the process. The outcomes in any business, let alone a business that relies on the success of other businesses, is of course impossible to control or predict. And seed is not a business to be in if your primary goal is to make loads of money fast. For me, I have to feel like the near-constant anxiety of running a (venture capital) firm is offset by laughter and lifelong friendship – and rich continuous learning too, which fortunately is ingrained in the job – to be worth the premature grey hairs.

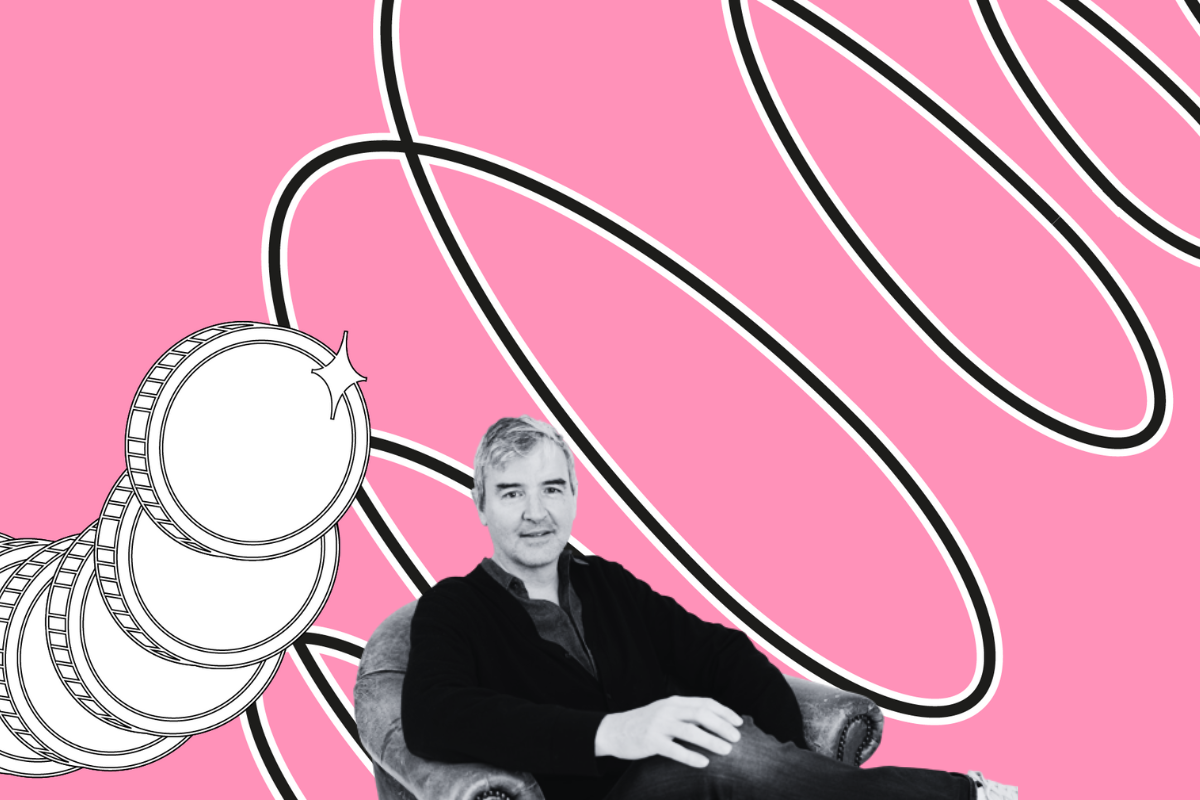

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Brent Hoberman, Cofounder and General Partner

What makes you want to invest in a startup?

Early stage investing is mostly about backing extraordinary people.

I have a question I ask myself when meeting a new founder, which is: “If I was early on in my career, would I go work for them?”.

If the answer is “definitely yes” then it’s a pretty good indication that this is someone we should think about investing in.

Do you have an investing philosophy, and if so, what is it?

At firstminute we are a generalist fund, so we back everything from developer tools to deeptech to foundational large language models. But across everything we do we look for people with magnetic ambition.

Timing is also really important to us. When starting a business you can’t be too late or too early so we want to make sure we are backing the right founders and just the right moment so their business is in the best position to get real traction.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

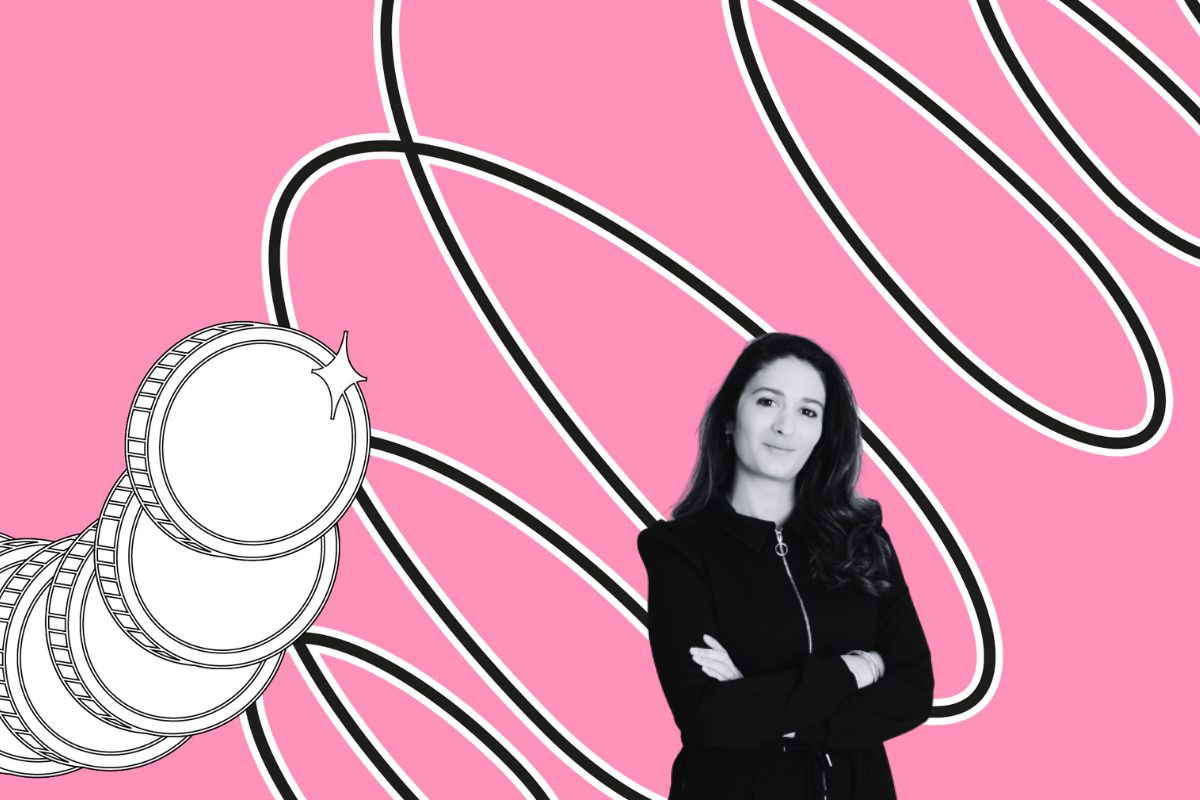

Lina Wenner, Partner

What is your vertical and what made you specialise in this area?

I have been a generalist investor from day 1 and my portfolio spans B2B SaaS, AI, gaming, consumer, developer tools and health/bio. I get excited by founders with big ideas across sectors. That said, the healthcare world is one that particularly fascinates me: it represents such a large part of our economy and has huge inefficiencies. Scaling a tech business in the space remains uniquely difficult, which puts many investors off. In my view, healthcare is one of those rare sectors where, when navigated correctly, significant financial upside can be coupled with massive societal impact.

Describe the characteristics of a firstminute founder?

We look for ‘talent magnets’: People who have a unique ability to rally the very best people around them. Our founders obsess about solving a certain problem, and inspire others to do the same.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Sam Endacott, Partner

What is your vertical and what made you specialise in this area?

Prior to firstminute, I worked in the Financial Institutions Group in Investment Banking at Goldman Sachs working on M&A transactions for banks, insurance and payments companies. Naturally when I started in venture my focus was on fintech. This was in January 2018 when there was a significant amount of innovation happening with regards to crypto. This community opened my eyes to the power of open source software and led me to focus on developer tooling – the history and talent in Europe here is really special and we’ve now assembled what we believe is a world class group in this category. After 5 and a half years in venture I would now however classify myself as a generalist within B2B software having backed founders across categories including fintech, crypto, AI / ML, e-commerce infrastructure, commercial open source and developer tools.

What makes you want to invest in a startup?

It’s really all about the founders at the seed stage. Can they hire world class talent? Have they felt the pain of the problems they are trying to solve? Will they be able to raise capital, move fast and scale as the company grows? The other important aspect at seed is market momentum. Does the market have momentum and the tailwinds to support a venture scale outcome in a 10 year horizon or will this team create a category with these dynamics.

Do you have an investing philosophy?

The most successful founders I’ve worked with are both great storytellers and operators. When you combine the two, amazing things happen. I like to assess both of these things when investing at seed.

Describe the characteristics of a firstminute founder?

Relentless and ambitious! They just see the world differently to us mere mortals!

What does a successful seed investment look like?

Going from idea to product-market fit enabling a company to raise a Series A to pour fuel on the fire and scale to the next stage so that their product can get into the hands of as many users as possible.

How do you quantify success?

Has the founder achieved their goals and did firstminute help them get there. As a fund with Limited Partners this also means we can make an outsized return and distribute that capital back to our investors (and hopefully this then gets recycled back into the ecosystem to fund the next generation of disruptors).

Why is venture capital important?

The world is facing significant challenges. It’s likely that many of these will be solved by a company that is backed by venture capital.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Adriana Vitagliano, Principal

What is your vertical and what made you specialise in this area?

I’m spending lots of time in climate and deep tech right now – we continue to see some of the most brilliant founders gravitating to the sector given the intersection of market opportunity and impact potential. As an investor, I’m fired up by the opportunity to be part of the solution to the climate crisis by backing exceptional founders building in the space.

I love working with founders on the edge of breakthrough science and commercial acumen. I started my VC journey as an investment partner at Creator Fund, an early stage fund which invests in founders from UK universities across deep tech and life sciences, spanning everything from AI to robotics to quantum computing.

What makes you want to invest in a startup?

When I’m so excited by the idea and founder energy that I’m halfway tempted to join myself! Hiring top talent is so crucial at seed – I use the “could I see my smartest friends wanting to work for this person?” litmus test.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Michael Stothard, Principal

What is your vertical and what made you specialise in this area?

I spent the first 15 years of my career writing. I was a foreign correspondent for the Financial Times and then I was the founding editor of the media company Sifted.eu. So when GPT-3 came out in 2020, and I saw this technology that could write basically as well as most journalists, it blew my mind. Today I invest mainly in Generative AI companies – along with my colleagues Sam and Lorcan. We are backing companies right across the gamut of use cases from foundational models to tooling companies to consumer applications.

What makes you want to invest in a startup?

The single most important factor is, of course, the team. We are looking for domain expertise but also an unusual or counter-intuitive way of thinking about a problem or a space. For me I also think a lot about the “why now”, by which I mean asking what about the market or technology has changed in the past six months that means that it’s now possible to build this business. On top of that – I need to be excited by the idea, because otherwise it’s no fun as a VC coming along on the journey.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Lorcan Delaney, Senior Associate

What is your vertical and what made you specialise in this area?

I got exposed to the social power of technology early on in life: when I was a child, my father used to be sent on missions to set up local network infrastructures in areas impacted by war zones and natural disasters. I remember being fascinated by his experiences, and, over time, realising the importance of software as an enabling medium for social connections, information sharing, value exchange, and efficiency. This belief accompanied me throughout my engineering degrees at UCL and Oxford, and subsequent experiences as an early-stage fintech operator and tech investment banker, and has led me to what today is a focus on software and data infrastructure, enterprise software, AI and financial technology. In my role as an investor, my objective is to discover the next wave of disruptive companies within these fields, and earn the right to support the founders into building enduring generational businesses.

Describe the characteristics of a firstminute founder?

I love spending time with founders who are driven by a deep and unreasonable sense of purpose, and leverage logic, rationality, grit and personal intuition as tools to analyse systems and transform ideas into realities. I believe that such qualities often translate into founders who have a strong vision and can clearly articulate the why and the how. In my opinion, these are foundational characteristics of a firstminute founder.

Why is venture capital important?

Startups are propellants for innovation and disruption. By challenging the status quo through new methods and technologies, they force industries to move forward and rethink what was previously taken for granted. The venture capital asset class plays an important enabling role in this dynamic, providing startups the fuel they need to reach their full potential.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Rose Davis, Associate

What is your vertical and what made you specialise in this area?

I started my academic and professional career planning to be a surgeon because I was passionate about caring for people in need and helping people become healthier. I was Pre-Med and completed a Bachelor’s degree at Yale University in Molecular, Cellular & Developmental Biology. However, as I spent time shadowing doctors in hospitals and clinics – it highlighted many severe problems within our healthcare system.

I realised that because the US healthcare system is very poorly incentivised, it isn’t the best platform to truly make humans healthier; and also that treating patients by hand does not scale. I became interested in technology as a way to impact people in a significant way on a greater scale and in venture capital as a way to help foster innovation and creativity in this space. I completed a Master’s degree at Imperial College London in Applied Biosciences and Biotechnology, and concurrently worked with Industry Partnerships & Commercialisation team to facilitate technology transfer of medical innovations spanning therapeutics, medical devices, and AI for healthcare.

Through this, I’ve also come to understand how challenging it is to get breakthrough innovation in this space into the hands of doctors or truly affect patients. I am passionate about finding a way to disrupt this; and have empathy towards founders navigating this poorly incentivised and challenging market.

Why is venture capital important?

Venture capital supports technological innovation and by proxy a positive impact on the world. It enables out-of-the-box and disruptive thinking that can fundamentally alter the health of the world and the people that live in it.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Will Wells, Venture Partner

What makes you want to invest in a startup?

Team, passion, energy and iconoclastic vision. Deep tech is a marathon not a sprint. I like investing in the rebels you can work with, the resilient and courageous, the confident but not the arrogant, and those founders with a clarity of vision strong enough to navigate any storm, even when they’re chips are down and they need to make the hard choices.

Why is venture capital important?

In my sectors – climate and deep tech – it’s the lifeblood source of development funding. Breakthrough science doesn’t grow on trees, deep tech is less bootstrappable than plain Jane SaaS, and it’s quite frankly a red flag if something lives and breathes on govt handouts alone!

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Steve Crossan, Venture Partner

What makes you want to invest?

Is the team taking on a big real problem and do they have a reasonable shot at solving it: can they build the team, learn fast, execute well, navigate the market and raise the capital they need?

Why is VC important?

The best VCs can accelerate the innovation that we need to solve many of the world’s challenges – both by taking the risk on an unproven idea and by providing access to the network of people and businesses that can help make it successful.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Min Nolan, COO

What does a best in class platform look like?

At firstminute we know that the most important thing at the early stage is the people. We look for founders who are talent magnets and will hire the best teams to go after the biggest problems. We think about our platform in five major sections where we believe we have the team best placed to help: talent, business development, fundraising, storytelling and events. Within those categories we aim to leverage our network to make introductions where it matters most: potential hires, investors (whether angels or later stage funds), advisors, customers and fellow founders. Knowing how little time our founders have, we try and curate our offering to each company so that we can help move the needle. This makes our platform offering a very human experience – best in class will be working out how we scale it!

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Abby Hughes, Operations Associate

What’s the toughest bit of supporting founders?

The toughest part is reacting to whatever the founders need at that time. Every week presents a new challenge, whether it be a wider external issue which affects a bulk of the portfolio, or an internal challenge which might require more focus. You never know what is around the corner and so it can sometimes require thinking on your feet, but we really do try to be an empathetic ally to our founders in whatever they’re facing. Therefore we make it our mission to really understand the challenges they are facing and go above and beyond to help where we’re able.

What do you find most fun about working in venture?

The most fun part for me is the opportunity to meet so many exceptional founders. When you first see a founder pitch they have such drive and dedication: their passion is both exciting and inspiring. We are lucky that everyday we are able to connect with founders right at the start of their journey and really support them as they grow and scale. It’s amazing to watch their progress from the sidelines and know that we were able to help.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Liv Price, Head of Portfolio

What’s the most common problem founders have?

Before raising their Series A, there are repeatable issues founders face when it comes to building out their teams. The main one is understanding who their key hires are going to be, the main outcomes those future roles will deliver on and how to organise their team in a highly efficient structure. Once that is established, it’s then about creating a compelling brand that attracts high quality people who don’t always exist in their immediate networks and leveraging clever retention strategies to make sure you hold onto those key hires that are going to be game changers.

Where can you add the most value for founders?

One of the most popular areas I spend time with founders on is creating hiring roadmaps. We do this by evaluating existing capability in their team and the gaps, then plot who are the critical people to externally bring in to mitigate those gaps. I also help across topics like engineering and product leadership hiring structures, compensation, talent acquisition (onboarding, interview process), performance management, as well as the less fun topics like running a layoff process.

My favourite way to spend time with founders is being in their offices, meeting most of the company and doing a deepdive on leadership team dynamics, communication, culture, figuring out areas they can tweak and identify what their superpowers are.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Anais Benazet, Head of Community

What benefit do founders get from community?

There is a magic that happens when our founders get together with each other and the wider firstminute community of investors and global CEOs. They get new ideas, they find people to hire, they meet people who want to invest and they get new business. It’s amazing to see it happen and to be part of curating that.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Anaïs Touton, Community and Events Associate

What’s the secret to a great event?

The secret to a great event lies in a combination of factors but the two main points to nail are over-planning and inviting the right people.

Successful events are usually the result of careful and thorough planning. This involves defining the event’s purpose, setting clear objectives, determining the target audience, and creating a detailed plan that outlines all the necessary steps and tasks. A well-planned event considers factors such as venue selection, logistics, scheduling, budgeting, marketing and promotion, and great food!

That being said, as much as you can plan for an event, so much of its success comes down to the attendees. Having a diverse mix of backgrounds and sectors always makes for the most interesting gatherings.

Lastly, find a creative way to stand out. For example, we held an event around Earth Day which featured an exclusive clip of Oliver Stone’s new film, Nuclear or we held a dinner in an immersive 360 art gallery with our investors and founders.

![Backed by 130 unicorn founders , firstminute capital announces $100M third fund]()

Christian Wassell, Head of Finance

Why did you get into venture?

I have worked in Private Equity based roles for most of my career, but in 2018 decided to start working with startups to gain some hands-on experience building and leading finance teams for smaller technology firms. After doing this for over four years and working with a number of early stage companies, I wanted to move back into financial services but in an environment that captured the personality, entrepreneurial spirit and enthusiasm of a startup. Venture capital, to me, represents the intersection of finance and innovation, where we not only help businesses grow but also shape the future by supporting disruptive technologies and solutions.

All in all, working in venture capital allows me to utilise my financial background and acumen in a dynamic, innovative, and impactful way.

What’s the biggest challenge or mistake you see over and over again in finance?

I have seen companies hire CFOs too early and waste funds on paying for an expensive resource where an outsourced bookkeeper would have been sufficient. I have also seen companies treat finance as an afterthought, hire too late and create a burden of administrative debt which is difficult to fully recover from as the company grows. Getting the timing right on a senior finance hire is (as with any other department) delicate and crucial.

The second challenge is to be cautious about what you’re outsourcing. Outsource tasks and processes, not knowledge. Too often, companies outsource the foundations of their internal financial data which results in reporting problems further down the line when they hire a more permanent finance department or switch outsourcing partners.